Top Companies with a Consistent History of Cash Dividend Payments on the Vietnam Stock Market - A Passive Investment Outlook

- Virtus Prosperity

- Jun 13, 2024

- 3 min read

Updated: Jul 17, 2024

As of the beginning of June 2024, many listed companies on the Vietnam stock exchange have announced plans or commenced dividend payments for the fiscal year 2023. Among these, numerous enterprises with a consistent history of cash dividend payments have set their payout ratios ranging from a highest of 80% to a lowest of 5%. This could be a suitable investment option for investors seeking passive income beside the increase of stock market value.

Below is a list of large-cap companies (with a market capitalization of over 1,000 billion VND), having relatively good liquidity (trading volume of around 200,000 shares traded/day or more with an average value over 20 sessions), and a consistent dividend payment history over the past 5 years.

1. Saigon Cargo Service Corporation (HOSE: SCS)

2. Hado Group JSC (HOSE: HDG)

3. Tien Phong Plastic Joint Stock Company (HOSE: NTP)

4. Viet Nam Technology & Telecommunication JSC (UPCoM: TTN)

5. Nam Long Investment Corporation (HOSE: NLG)

6. Binh Dien Fertilizer Joint Stock Company (HOSE: BFC)

7. IDICO Corporation – JSC (HNX: IDC)

8. Petrolimex Petrochemical Corporation - JSC (HNX: PLC)

9. Dong Hai Joint Stock Company of Bentre (HOSE: DHC)

10. Vietnam National Petroleum Group (HOSE: PLX)

11. Saigon Beer - Alcohol - Beverage Corporation (HOSE: SAB)

12. SSI Securities Corporation (HOSE: SSI)

13. Viet Nam Dairy Products Joint Stock Company (HOSE: VNM)

14. Phu Nhuan Jewelry Joint Stock Company (HOSE: PNJ)

15. FPT Corporation (HOSE: FPT)

(Source: Vietstock)

(Source: Vietstock)

In addition to cash dividend payments, shareholders also receive dividends in the form of stock dividends, rights to purchase shares at preferential prices, and bonus shares at certain ratios.

The highest stock dividend payout ratio in this list is 100% (equivalent to investors receiving an additional share for each share held) for the fiscal year 2023 of Saigon Beer Alcohol Beverage Corporation (Sabeco). Besides stocks, investors also receive a 15% cash dividend, equivalent to 1,500 VND per share held. Sabeco is a leading company in the beer production sector in the Vietnamese market with annual revenue fluctuating around 30 trillion VND. Sabeco's gross profit margin over the past 5 years has consistently maintained around 30%. The average post-tax profit over the past 5 years is approximately close to 6 trillion VND.

SSI is the only company in the list to maintain a consistent 10% cash dividend payout ratio each year. Additionally, SSI shareholders also receive a 16% stock dividend for the year 2019 and rights to purchase shares at preferential prices for the years 2021 and 2022, at ratios of 6:1 and 2:1 respectively, with prices of 10,000 VND/share and 15,000 VND/share.

Vietnam National Petroleum Group (Petrolimex) and its subsidiary Petrolimex Oil Corporation are the only companies in the list that only pay cash dividends. The cash dividend payout ratio of PLC has remained relatively stable compared to the parent company: 15% over the 3 years from 2019 to 2021, and 12% for the years 2022 and 2023.

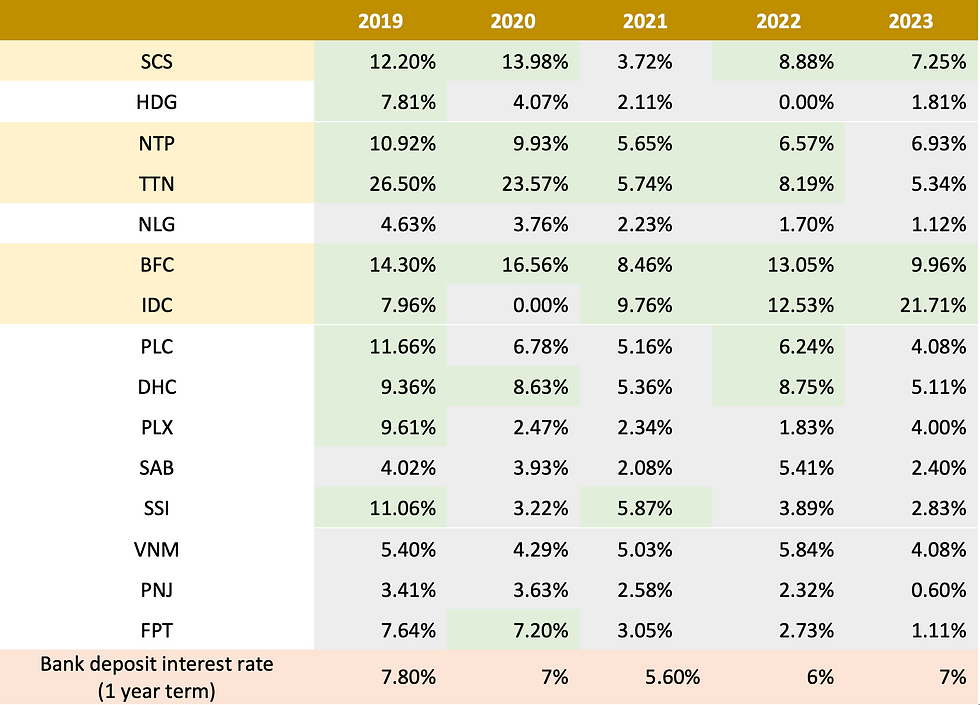

Table: Dividend yields of several listed-company comparing with bank savings interest rates.

In the list above, there are five enterprises with dividend yields surpassing the interest rates of equivalent term bank deposits in the last 5 years, including: Saigon Goods Services Company, Teenage Plastics Phong, Vietnam Technology and Communication Corporation, Binh Dien Fertilizer Joint Stock Company, and IDICO.

The remaining enterprises, although their cash payout ratios are lower than bank interest rates, the intrinsic value of their stocks has shown clear growth, providing investors with profits comparable to dividend income. Exemplary cases include Nam Long Investment Corporation, with stock capital increasing by 114.89% over 5 years (calculated from the ex-dividend date of 2019). Similarly, SSI increased by 291% over 5 years, with a notable 243% increase in 2020.

Table: Data regarding the increase in stock capital

In conclusion, the listed enterprises on the Vietnam stock exchange, as outlined, present compelling investment opportunities for those seeking passive income and potential capital appreciation. With consistent histories of dividend payments, ranging from cash dividends to stock dividends and bonus shares, these companies offer diverse avenues for shareholder returns. Additionally, some companies exhibit robust growth trajectories, further enhancing their attractiveness to investors. Whether through stable dividend income or capital appreciation, these enterprises showcase the dynamic potential of the Vietnamese stock market, offering avenues for both short-term gains and long-term wealth accumulation. As always, investors should conduct thorough research and consider their investment goals and risk tolerance before making any investment decisions.

Comentarios